Skyrocket Your Commercial Real Estate Rental Income

As a savvy commercial property owner or investor, you know the ultimate goal: extracting every ounce of potential from your real estate venture. But let’s be real – navigating the dynamic rental market can be a minefield of missed opportunities and untapped profits. Fear not, because we’re about to embark on a journey that will transform your rental income from a trickle to a raging torrent of cash flow. Buckle up and get ready to unleash the cash cow within your commercial property!

Conduct Thorough Market Research

Understanding the local market dynamics is essential for setting competitive rental rates. Regularly analyze comparable properties in your area, considering factors such as location, size, amenities, and age. This data will help you price your rental units accurately, ensuring you’re not leaving money on the table or pricing yourself out of the market.

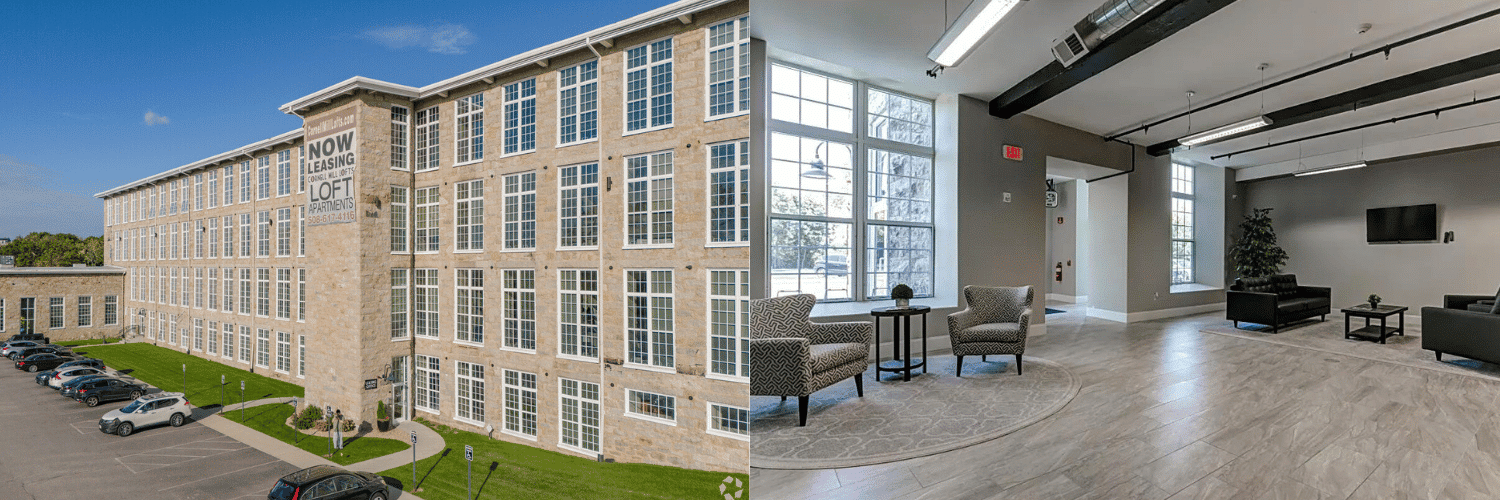

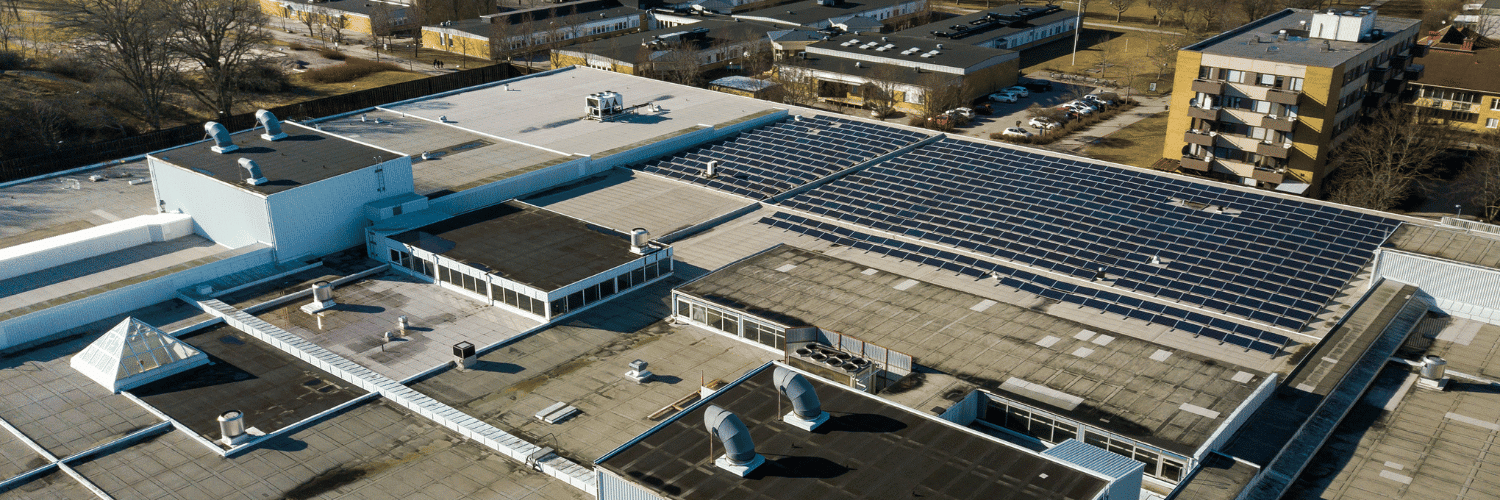

Maintain and Upgrade Your Property

A well-maintained and appealing property can command higher rental rates. Regularly invest in property improvements, such as renovations, energy-efficient upgrades, and attractive landscaping. These enhancements not only attract and retain quality tenants but also justify rental rate increases.

Offer Desirable Amenities

Tenants are often willing to pay a premium for convenient and desirable amenities. Consider adding features like ample parking spaces, on-site security, fitness centers, or conference rooms. These amenities can differentiate your property and justify higher rental rates.

Implement Effective Tenant Screening

Thoroughly vetting potential tenants can save you from costly vacancies, defaults, and property damage. Establish clear tenant screening criteria, including credit checks, income verification, and reference checks. This process helps ensure you attract reliable, long-term tenants who can consistently pay rent on time.

Leverage Technology

Embracing technology can streamline property management tasks and enhance tenant satisfaction. Implement online rental payment systems, digital maintenance request portals, and smart building technologies to improve efficiency and provide a seamless experience for your tenants.

Optimize Lease Terms

Carefully structure your lease agreements to maximize rental income. Consider including clauses for periodic rent increases, escalation clauses tied to inflation or market rates, and terms that incentivize long-term tenancy. Additionally, offer flexible lease options to cater to different tenant needs, such as short-term or month-to-month leases at a premium.

Foster Strong Tenant Relationships

Maintaining positive tenant relationships can lead to higher retention rates and reduced turnover costs. Promptly address maintenance issues, be responsive to tenant concerns, and foster open communication. Satisfied tenants are more likely to renew their leases and may even be willing to pay higher rents for the excellent service they receive.

By implementing these strategies, you can position your commercial real estate property for success, attract high-quality tenants, and maximize your rental income over the long term. Remember, consistent property management efforts and a commitment to providing an exceptional tenant experience are key to achieving sustainable rental income growth.

Disclaimer: The information provided in this article is for educational purposes and should not be considered financial or investment advice. It is always recommended to consult with a qualified financial advisor or investment professional before making any investment decisions.